Post Earnings Price Changes

Alphabet, Inc (GOOGL): +10%

Meta Platforms, Inc (FB) : -26.39%

Amazon.com, Inc (AMZN): 13%

January 2021 has been the worst month for the market since March 2020. The S&P 500 was down 5.6%, and the Nasdaq was down 8.98%. The month ended on a mixed note with the Fed indicating rate hikes in March, a slew of tech stocks were hammered back to reality (sorry Peloton and Netflix), but some technology stocks held firm, including Microsoft and Apple. The market, especially in tech stocks, is recalibrating from last year's ATHs across the board and sorting out who deserves their current valuations.

This week, Alphabet, Meta, and Amazon were up to bat with their earning reports to see if they deserved their gains.

First up to bat this week was Alphabet. On Tuesday, Alphabet reported better than expected Q4 earnings, beating revenue expectations by $3 billion and revenue growing 32% from the previous quarter. Following the earnings report, Alphabet was up 10%. In addition, the impact score for "Google Stock" has seen a steady decline since the fall of 2021, but the future projection for impact score ticked up going into February.

Alphabet also announced a 20-for-1 stock split. Interestingly, in the weeks leading up to the Alphabet stock split, two inflection points were triggered by the NWO.ai platform for the "Google Stock Split" signal. An inflection point is triggered when there is a significant change in the acceleration of conversation.

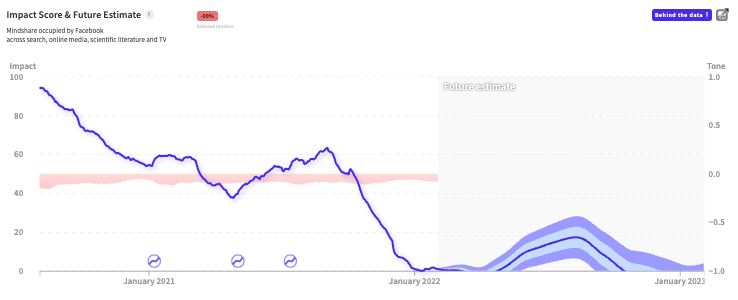

On the other hand, Meta had a disastrous performance after its Q4 earnings report. The stock dropped over 25% and set a record of losing $237.6 billion in market value in a single day. The impact score for "Facebook" has seen a steep decline over the past few months, and the tone in the conversation has been negative. Meta is facing challenging headwinds, including Apple's new iOS policy, users leaving for rivals (e.g., Tik Tok), its ability to engage in M&A without regulator scrutiny, and its ability to attract employees and companies to work with them due to its reputation. Despite Meta's new name, the pivot to becoming a dominant player in the metaverse space will not come to fruition anytime soon, even if the pivot is successful.

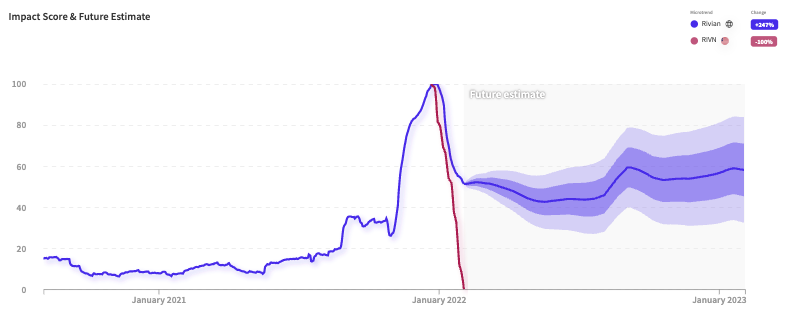

During the day Thursday, Amazon was down 6%, battered by negative consumer sentiment, indicating that the Q4 earnings report would be bad due to supply chain constraints, lower holiday shopping numbers, and as a secondary effect of Meta's disastrous performance. Despite this, Amazon is up 13% mid-day today after its Q4 earnings results. On the surface, the Q4 earnings did underperform. Amazon did not beat revenue expectations and gave bleaker guidance than projected. So why is it up? Even our signal that is 98% correlated with the Amazon stock price, showed that it was down. Well, there was a narrative violation that the consensus didn't catch, Rivian.

In November, Rivian was priced at $78 per share at IPO, and Amazon held 22.4% of the companies Class A shares. Over the next six days, Rivian's stock price climbed 120% to $172, netting Amazon $11.8 billion in pre-tax valuation gains and making up 84% of its reported net income in Q4. Despite poorer holiday shopping numbers, if investors zeroed in on this data point, they may have recognized that Amazon would be able to make up for the shopping numbers with its investment in Rivian. Moreover, despite peaking in December, the impact score for Rivian is projected to grow steadily into 2022, potentially indicating that the stock has room to recover.

So, where does that leave us for the future? While it's hard to state with certainty, especially in this time of market volatility, NWO.ai will continue to monitor the consumer narrative to understand how it pushes the market.

About NWO.ai

NWO.ai's predictive platform enables leading Fortune 500 companies and government agencies to anticipate and track global cultural shifts by aggregating, analyzing, and producing actionable reports on human-generated data. We are leveraging petabytes of external, noisy, and unstructured data from various sources –including search, social media, blogs, news, patent databases, SEC filings and we are continuously adding more sources. Our mission is to answer the what, when, and most importantly, 'why' behind a consumer trend and enable our customers to detect these shifts as early as possible.

P.S. We're hiring! Check out our open positions and let us know if you'd be a good fit for our team. We're growing quickly and adding several engineering roles to help us decode the anatomy of next.

Thank you for reading. If you liked the piece, please help us spread the word and invite your friends to sign up here.

Disclosure: NWO.ai does not have a position in any equities, commodities, or cryptocurrencies mentioned. Nothing contained in this website should be construed as financial advice

Join the conversation.