Edited by Julia Myers

This week is going to be one that we’ll remember for years to come. Our nimble team at NWO.ai had a bit of a Michael Burry moment, where our AI engine went against the grain and scored big. Here’s the lowdown:

On the hunt for anomalies

Thanks to NWO.ai’s powerful software suite, we empower our customers to accurately make predictions about trends that are often intuitive and hardly ever the cause of cognitive dissonance. But every now and then, our algorithms surface insights that are highly contrarian, even unconventional, leaving us scratching our heads. NWO.ai’s forecast on Affirm, a leading Buy Now Pay Later finance company, was just that - unexpected, yet surprisingly insightful.

Setting the stage

It all began precisely 72 hours ago as our team formulated our Earnings picks of the week for our customers and investors. Our first prediction on Chipotle’s earnings was spot on, and $CMG rose 10% shortly after. Around the same time, we began noticing a massive spike in chatter related to Affirm, which was set to announce its earnings on Thursday after market hours. The conversations were extremely bullish and the stock rose an unhealthy 20% in tandem - which is when NWO.ai’s signal for Affirm first caught our eye.

Sell Now Ask Later

One of the biggest players in the Buy Now Pay Later space, Affirm has long had a strong footing in the industry, including an exclusive contract with Amazon. The release of its SuperApp and accompanying browser extension saw the stock price skyrocket, with the hype surrounding its rapidly expanding customer base and the addition of 168,000 merchant partners.

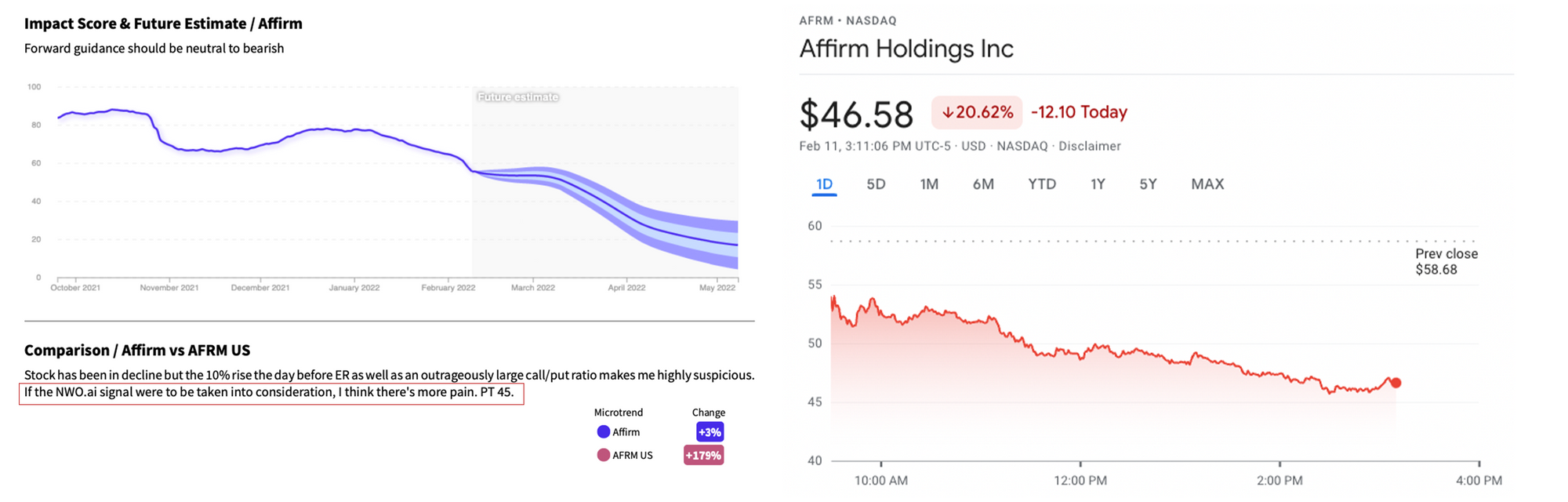

A quick search on NWO.ai for “Buy Now Pay Later” reveals our proprietary Impact Score signal that measures the true saturation of conversations around this topic across social media, news, search engines, financial literature, and even TV stations. The signal showed a massive spike in July 2021 followed by a worrying decline after several publications reported on the dangers of the service in encouraging overspending and its lax standards for approval, reflected in the negative sentiment our platform picked up. Even the holiday shopping period led to an unimpressive rise, relative to the same time last year. That was my first indication that this unhealthy bullishness ahead of ER might be misplaced.

NWO.ai’s forecast, which takes into account dozens of signals and data source characteristics, also indicated a likely neutral to bearish outlook for Q1 2022.

To confirm my hypothesis in a more quantitative manner, I made use of NWO.ai’s powerful financial overlay tool to visualize NWO.ai Signal for Buy Now Pay Later vs $AFRM. The correlations were startling, exceeding 96%.

At this point, I couldn’t help sharing my analysis internally with my team and our partners.

Lights, Camera…. Rug Pull

Late in the afternoon on Thursday, Affirm was unexpectedly forced to publish results after a "human error" caused a misleading earnings chart to be prematurely posted to Twitter, leading Affirm to bite the bullet and release its full set of results a few hours ahead of schedule rather than to allow speculations to run wild on partial information.

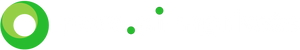

Investors shredded close to $4 billion in market value from the San Francisco-based FinTech in less than an hour, essentially doubling a pre-existing three-month sell-off that has now cut Affirm's valuation by 60%.

How did this slump come about purely from the Earnings Report perspective? "AFRM conservatively raised 2022 guidance much lower than anticipated expecting a sequential decline into Q3 due to seasonality, Peloton and difficult comparisons (despite larger partnerships continuing to ramp)," said Deutsche Bank Analyst Bryan Keane in a report.

Our Price Target of 45 was spot on, with the price as of this moment hovering around $46.

I’ll leave you with a quote from the Big Short that I swear by. I wish you a fantastic weekend ahead.

Pulkit

Thank you for reading. If you liked the piece, please help us spread the word and invite your friends to sign up here.

Disclosure: NWO.ai does not have a position in any equities, commodities, or cryptocurrencies mentioned. Nothing contained in this website should be construed as financial advice

Join the conversation.