If there was one word to describe this earnings season, it would be volatile. The market has seen a retreat from its heights at the end of 2021 and is picking out the winners and losers. Our team here at nwo.ai has analyzed the conversations driving the market to identify which companies offer the best opportunities for Alpha. In this issue of nwo.ai markets, we are looking at a stock that our platform is bullish on based on consumer conversation.

Chipotle (CMG)

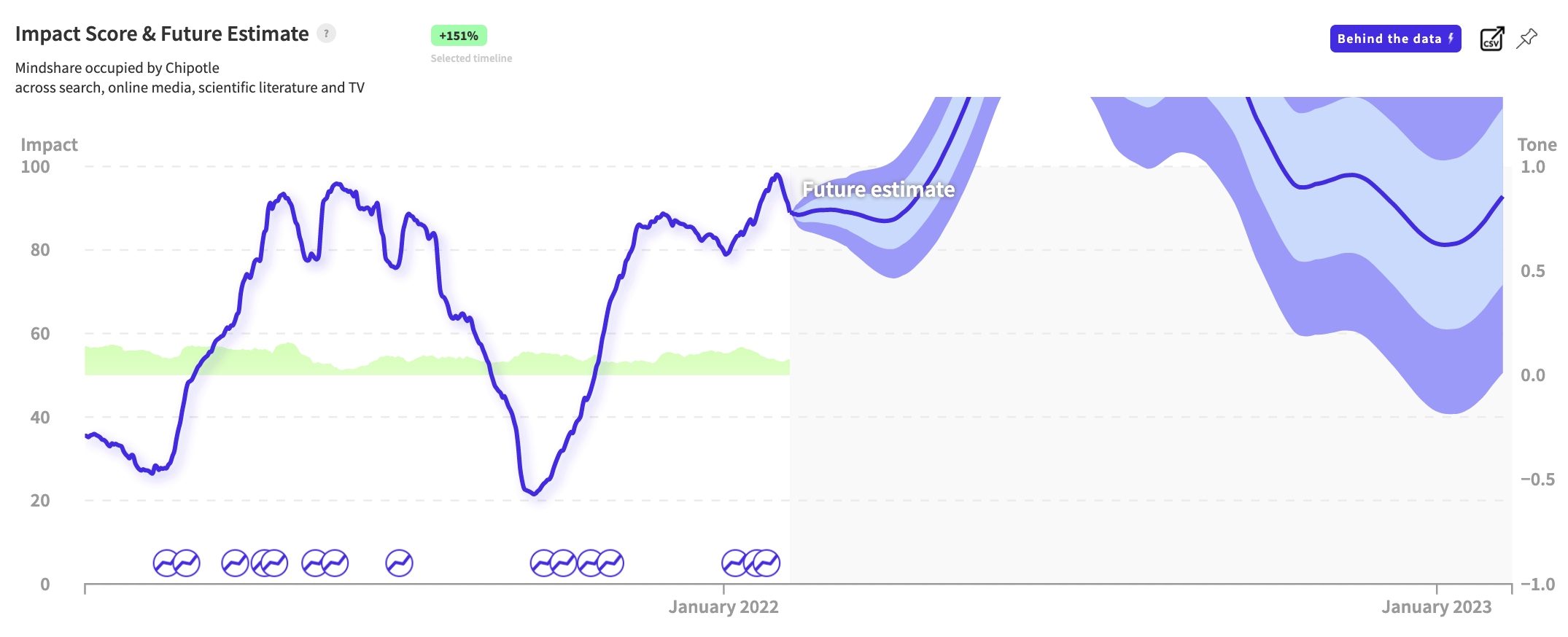

Chipotle is scheduled to report on Q4 earnings today (February 8th) after market close. Analysts expect earnings per share of $5.25, up from $3.48 per share in Q4 of last year. Chipotle is also expected to report a 21.91% increase in revenue from Q4 of last year. NWO.ai has seen a significant increase in conversation over the past three (3) months, with the impact score reaching a peak of 100 and projected to grow significantly into 2022. Despite the ongoing labor shortages and price increases (these factors have impacted all of Chipotles peers, too), Chipotle remains popular with consumers. NWO.ai's sentiment analysis shows that the consumer conversation for Chipotle has been positive, with most of the chatter for the signal coming from News and Social Media sources.

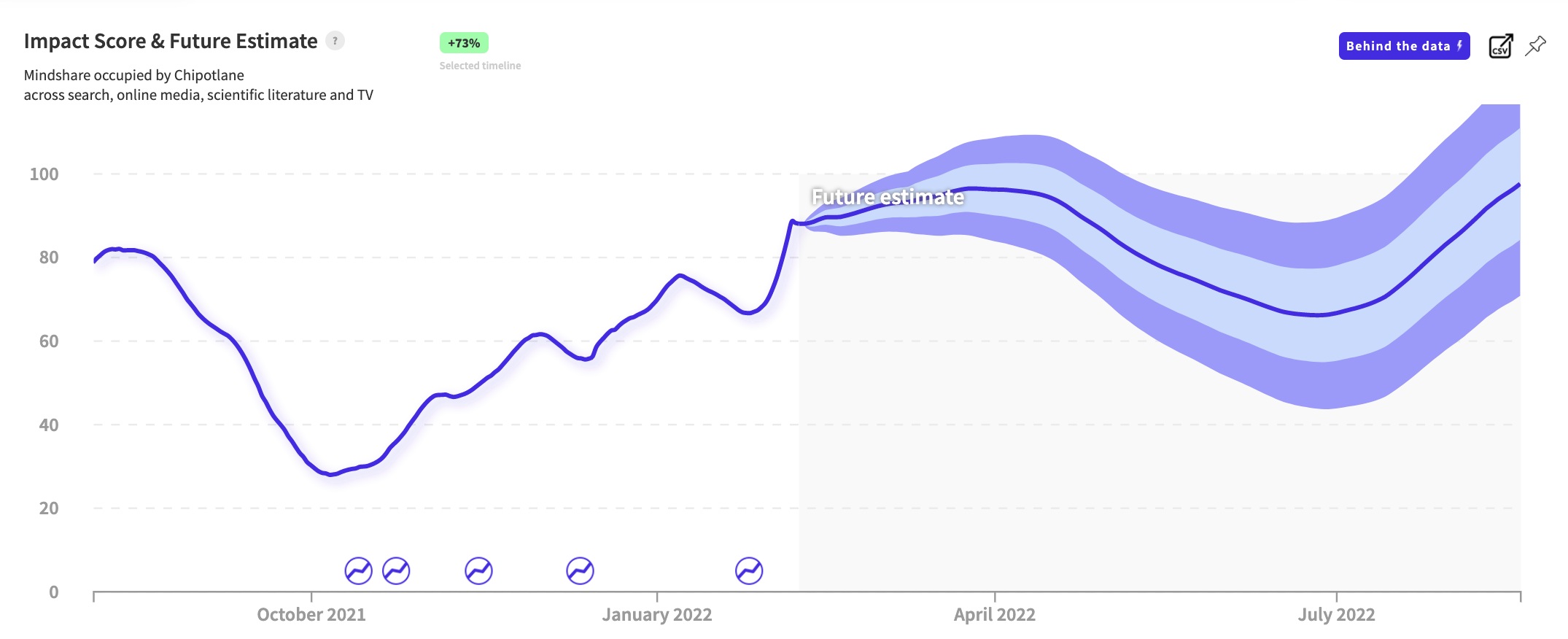

Chipotle continues to invest heavily in digitizing its ordering process and has even rolled out "Chipotlane" (a drive-through chipotle, which interestingly is growing in impact score).

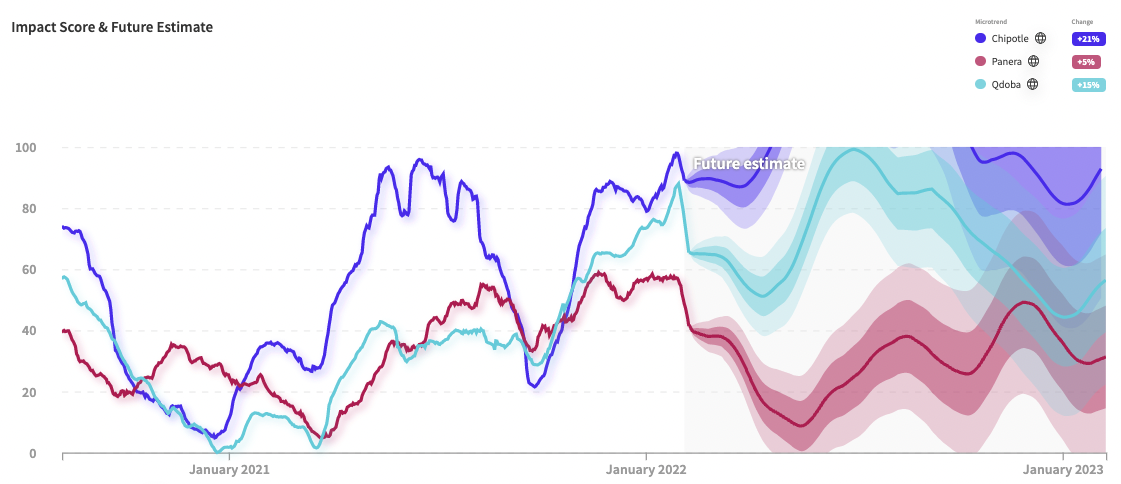

Chipotle has outperformed its peers, Panera and Qudoba, in consumer conversation in recent months and is projected to continue to do so into 2022.

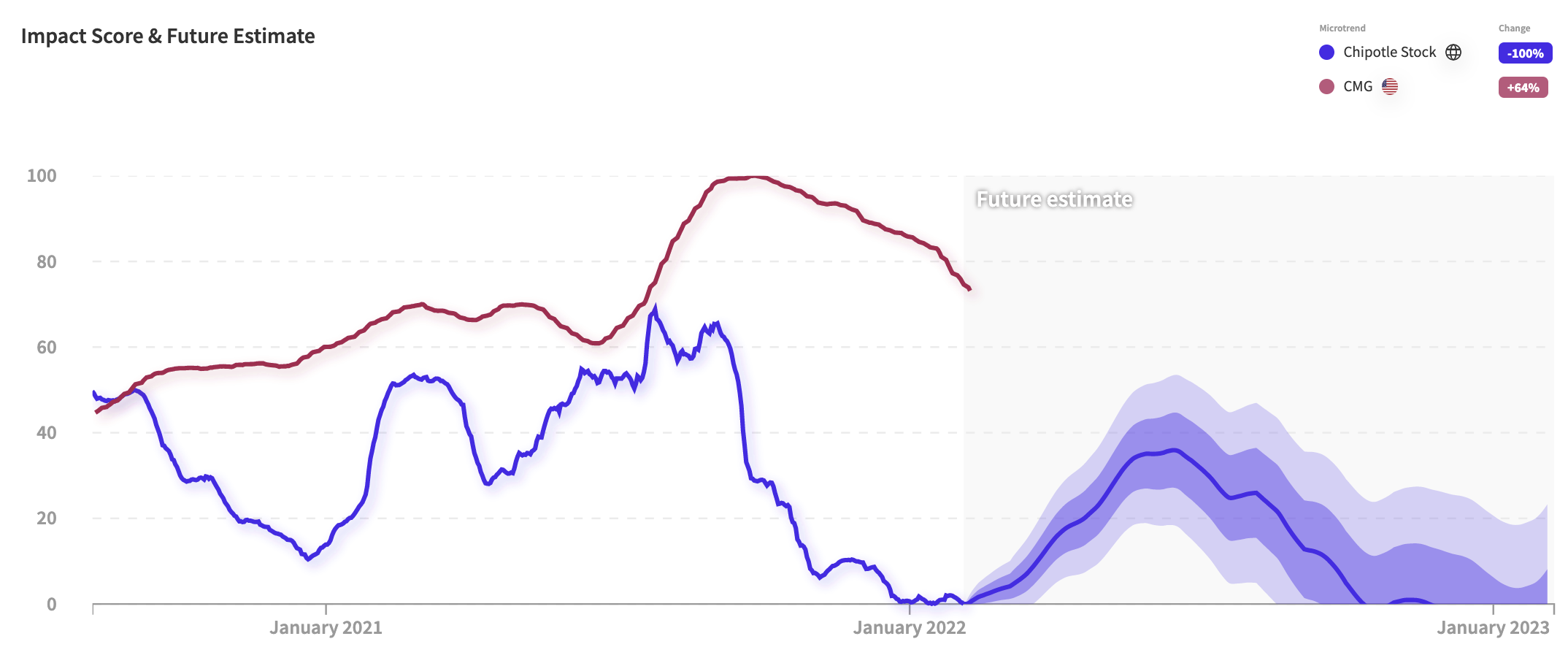

NWO.ai's signal for "Chipotle Stock" leads Chipotle's stock price by 14 days and is 86.69% correlated with the signal. NWO.ai is forecasting a sharp uptick in the "Chipotle Stock" conversation over the next few months. Chipotle has declined 25% in the last three months, retreating from its ATH at $1,958.54. Given the growth in positive consumer conversation, digital innovation, greater consumer conversation performance relative to their peers, and a great earnings report, the stock may trace back to the 200-day moving average of around $1700 over the next six months.

About NWO.ai

NWO.ai's predictive platform enables leading Fortune 500 companies and government agencies to anticipate and track global cultural shifts by aggregating, analyzing, and producing actionable reports on human-generated data. We are leveraging petabytes of external, noisy, and unstructured data from various sources –including search, social media, blogs, news, patent databases, SEC filings and we are continuously adding more sources. Our mission is to answer the what, when, and most importantly, 'why' behind a consumer trend and enable our customers to detect these shifts as early as possible.

P.S. We're hiring! Check out our open positions and let us know if you'd be a good fit for our team. We're growing quickly and adding several engineering roles to help us decode the anatomy of next.

Thank you for reading. If you liked the piece, please help us spread the word and invite your friends to sign up here.

Disclosure: NWO.ai does not have a position in any equities, commodities, or cryptocurrencies mentioned. Nothing contained in this website should be construed as financial advice

Join the conversation.