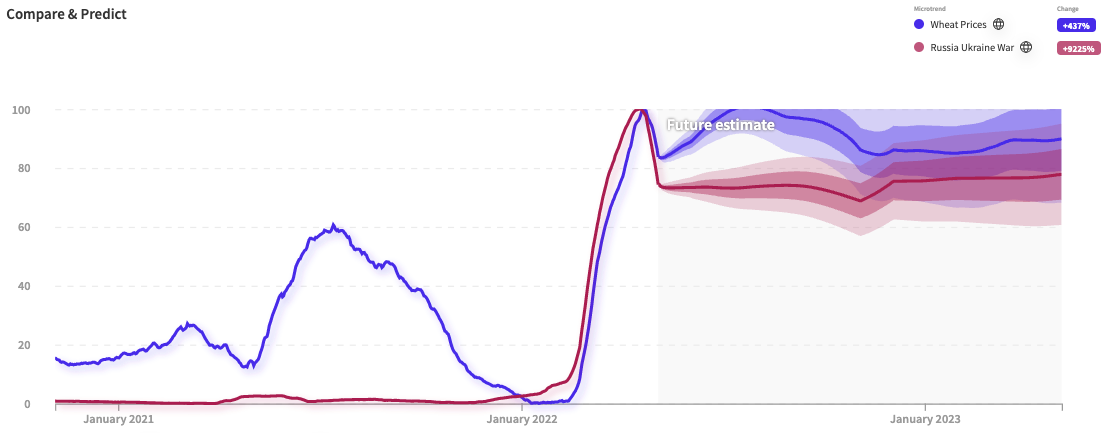

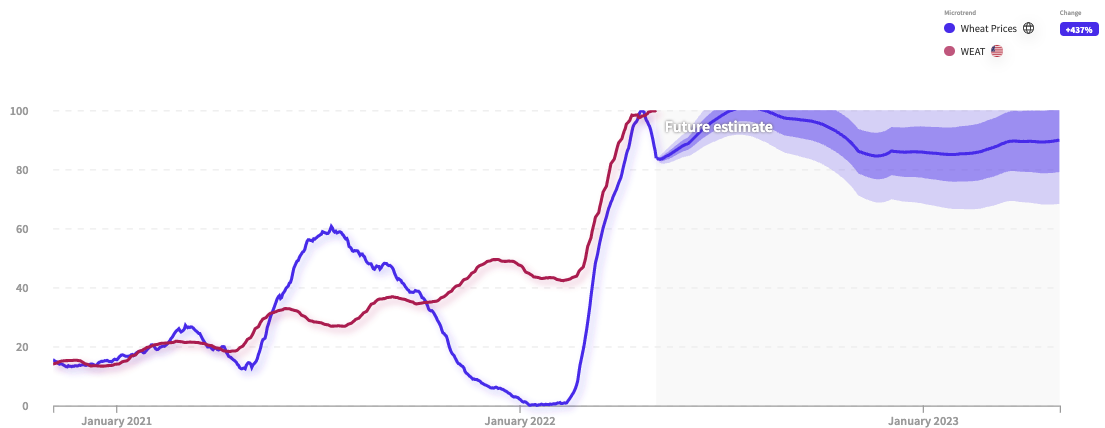

Since February 1st, wheat prices have increased by 40%. The wheat futures ETF $WEAT has grown 45% in that same period. In January, I wrote for NWO.ai Markets that investing in wheat futures would be a good hedge against the looming Russia Ukraine War and inflationary pressures. Despite the run-up in wheat prices over the past three months, our signals indicate that the price still has plenty of room to grow as we enter the summer due to geopolitical, economic, and climate considerations.

Why will the price of wheat continue to go up?

I. Prolonged Russian War in Ukraine

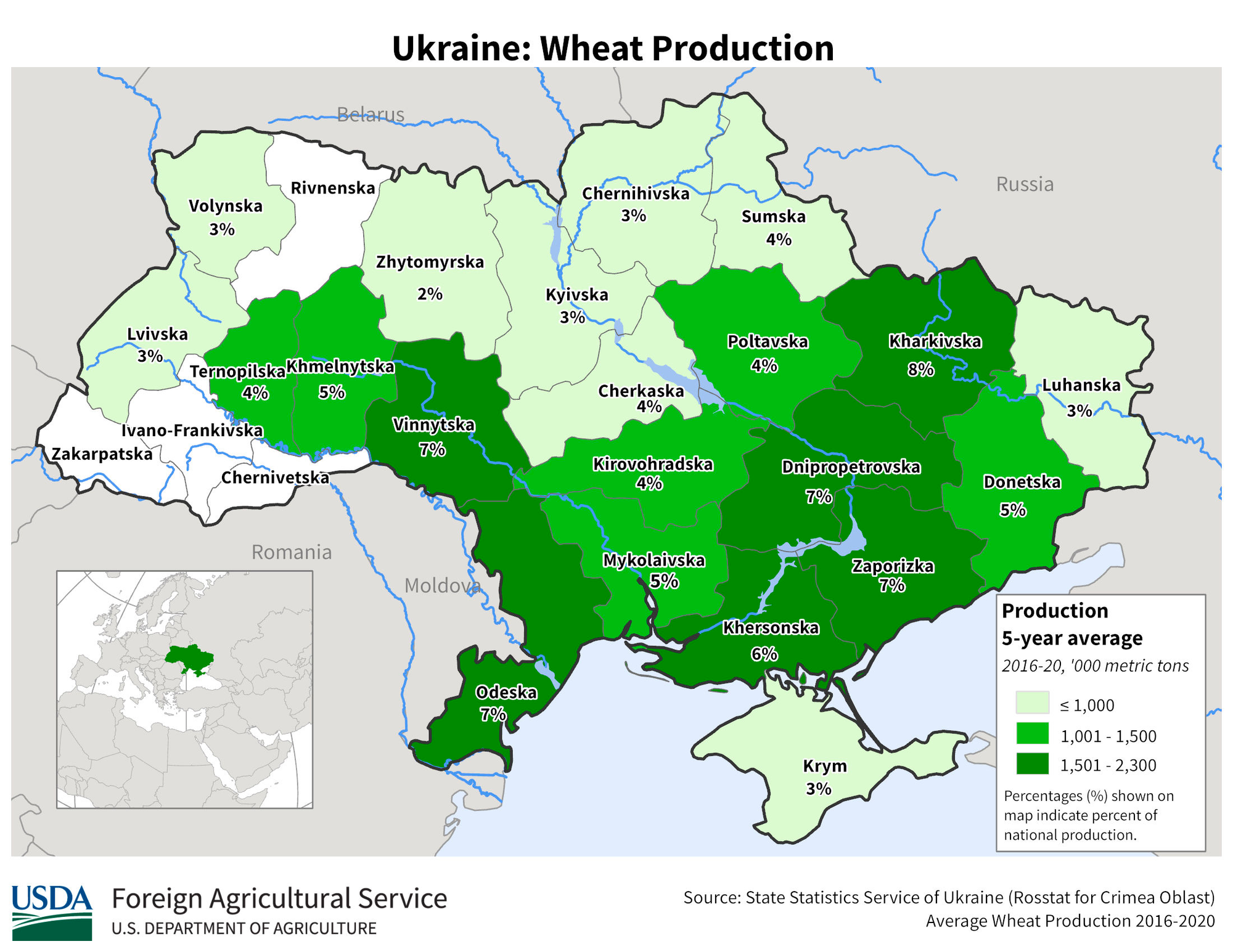

Ukrainian farmers have so far sown 30% of the total wheat crops for the 2022 spring planting season. According to Reuters, Ukraine's wheat production is expected to fall by 20% this year (the Ukrainian agriculture ministry hasn't given its official estimate yet, but the figures could be worse if fighting pushes into the farming regions). The challenge for Ukraine will be its ability to export the wheat it produces. 4.5 million tons of grain are currently sitting in Ukrainian ports as Russia blockades its exports. Additionally, there have been reports that Russian troops have stolen hundreds of thousands of tonnes of grain and millions of dollars worth of farm equipment from Ukrainian farmers in Donestska and Luhanshka. If Ukraine cannot push out the grain it makes, it won't matter how much it can grow.

The majority of Ukraine's wheat production is in the East and South of the country, where the bulk of the fighting is taking place. From a strategic perspective, Russia may be looking to seize this land to bolster its own production. If that happens, it will be too late for this year's planting season. In addition, some experts anticipate that Russia may expand the invasion of Ukraine by formally declaring war on the country on May 9th (Russia's Victory Day), further increasing the economic and human cost of the war.

Despite crippling Western sanctions, Russia continues to export wheat, and prices are down domestically. Russian wheat exports are up 25% from the five-year average during this time of year. Turkey and Iran are the largest known importers of Russian wheat. In March, Russia announced it was banning wheat exports to European countries, which left some countries scrambling. However, it's unlikely the West will ban wheat exports from Russia, as it would have devastating consequences for the world.

II. Export bans?

A few counties are looking at banning or limiting wheat exports to keep domestic prices low. The first wheat producer to restrict wheat exports was Kazakhstan. Kazakhstan's government announced a temporary export quota until at least June 15th. Kazakhstan provides the majority of the wheat imports to its Central Asian neighbors. For example, Tajikistan imports 96% of its wheat from Kazakhstan.

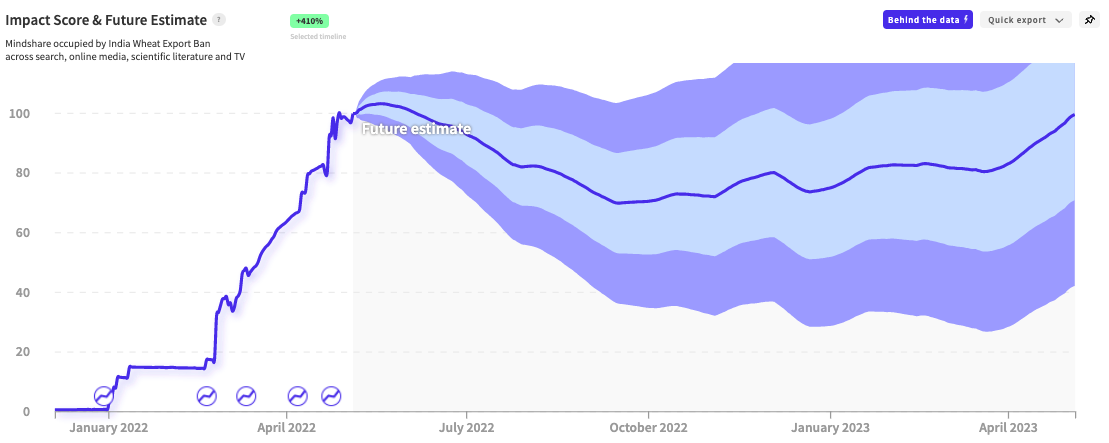

According to reports, the Indian government is mulling over a plan to ban wheat exports. Severe droughts and heat have struck India in recent weeks, with temperatures soaring above 110 degrees Fahrenheit. As a result, the Indian agriculture ministry has reduced its production outlook for the crop from 111 million metric tons to less than 105 million metric tons (a 4.5% drop). If levels drop below 100 million metric tons, India will become a wheat importer unless it halts its exports.

Suppose a ban comes down from government officials. In that case, the nations hardest hit will be the ones already most vulnerable to food shocks, including Bangladesh, Nepal, Sri Lanka, Yemen, Afghanistan, Oman, Indonesia, and Malaysia.

III. Drought conditions in wheat-growing regions

Drought conditions are not isolated to India. From the United States and Canada to New Zealand, extreme weather is impacting this year's planting season. The United States and Canada are the second and third largest wheat exporters behind Russia.

The United States mid-west, the heartland of America and wheat production, has been plagued with drought conditions since the fall. Additionally, persistently high winds in the region have led to dust kicking up and burying wheat crops and contributing to even dryer soil conditions, worsening the issue further. On May 2nd, the USDA reported only 27% of the winter wheat crop were rated in good to excellent condition, the lowest level since 1989. According to the US drought monitor, 70% of the Southern Plains are experiencing drought conditions, and there is little relief in sight.

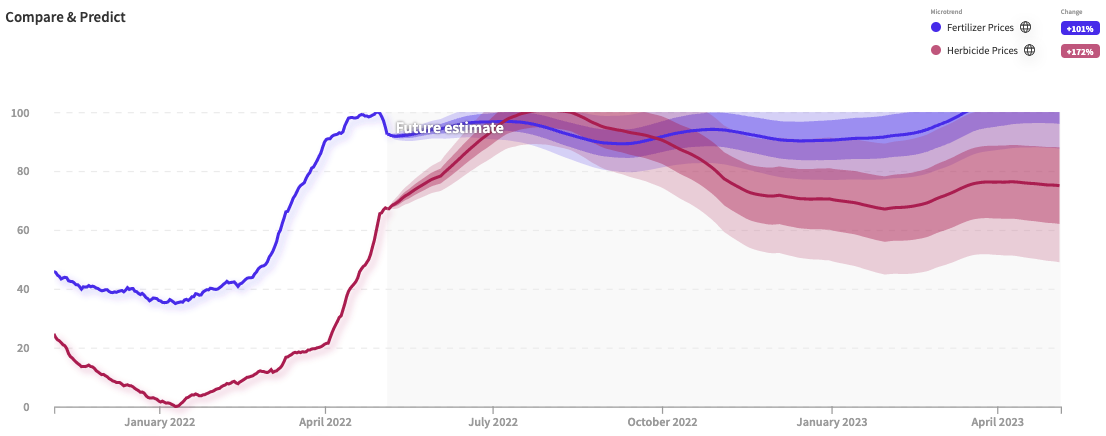

IV. Increased costs of inputs into wheat production

Back in mid-March, we wrote about the coming rise in fertilizer prices due to the Russian war in Ukraine. By the end of that month, fertilizer prices had risen 25%. Additionally, the price of Herbicides and other inputs into wheat production globally has increased. As a result, NWO.ai projects the signal for Fertilizer and Hebercide Prices to explode in the coming months. Additionally, farmers will spend more money on planting and harvesting the grains with rising fuel prices. Then the price of shipping the wheat is, also, going to increase with higher fuel and storage costs. Also, the inputs to the inputs of wheat are likely to increase in price. But I won't list all those out.

The point is that the entire upstream and downstream costs of producing wheat will increase.

Hedging market downturn with wheat

Historically, commodities have been a good hedge against high inflation and slow economic growth. The last time wheat prices reached their all-time high was during the '07 - '08 financial crises.

NWO.ai analyzed several different wheat companies and ETFs; we found that $WEAT, an ETF that looks to track wheat futures, is highly correlated to our signal for wheat prices. The ETF price is 99.13% correlated with our impact score, and our signal leads the $WEAT price by 14 days. In other words, consumer conversation is the leading indicator of the price. Furthermore, our impact score estimates that the conversation for Wheat Prices will continue to increase through the summer, before dropping off slightly in the fall. Therefore, we were bullish on $WEAT's performance, at least through the summer.

Wrap-Up

In short, there are four factors that I'm anticipating will drive up the price of wheat; a prolonged Russian war in Ukraine, India's pending export ban, drought, and prices for the inputs in producing wheat.

In the long-term, to quell wheat prices governments such as the United States, China, India, Russia, and the EU should work together to open up their wheat reserves to the global market to bring down the price and ensure that vulnerable countries can feed their people.

Thank you for reading. If you liked the piece, please help us spread the word and invite your friends to sign up here.

Disclosure: NWO.ai does not have a position in any equities, commodities, or cryptocurrencies mentioned. Nothing contained in this website should be construed as financial advice.

Join the conversation.