On Friday, January 21st, Netflix (NFLX) shares plunged after it reported its fourth-quarter earnings. Today, Netflix was down over 20% and 43% from its all-time high. While it beat profit and revenue expectations, shareholders zeroed in on Netflix’s slowing subscriber growth. Netflix had forecasted its subscriber base would grow 8.5M in Q4’ 22 but only grew 8.3M. Additionally, Netflix forecasted that subscriber growth would be 2.5M in Q’1 22, down from its growth of 4.0M subscribers in Q1’ 21.

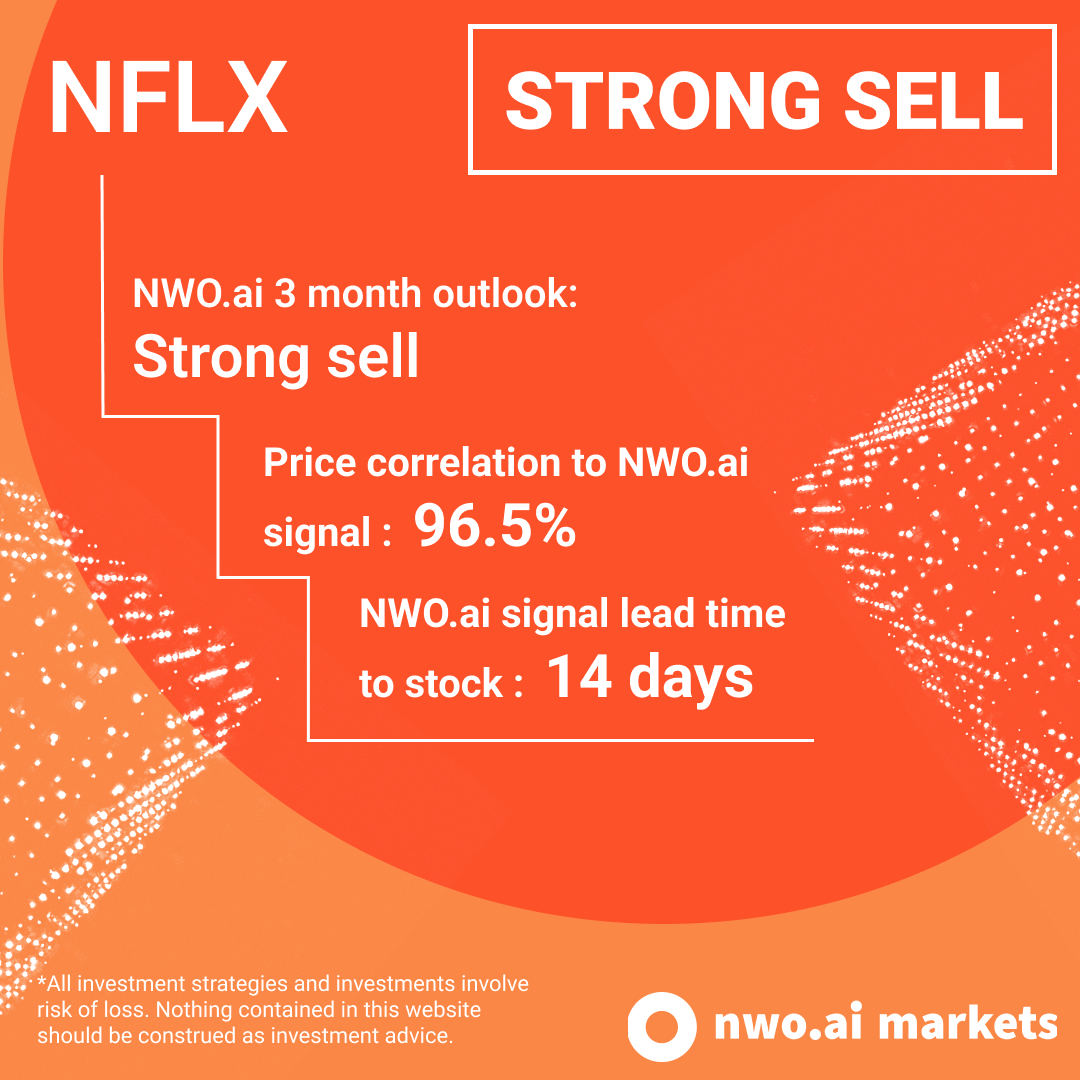

NWO.ai has seen a consistent drop in Netflix’s impact score since it peaked during the pandemic. While the stock price soared, the underlying consumer sentiment around the company shrunk. Why? Lifting of restrictions, the rise of new competitors, and their inability to grow into new markets.

The impact score for Netflix tracked closely with the signal for “Return to Work.” As people have entered the “new” normal, consumption of at-home entertainment is down compared to earlier in the pandemic.

As the streaming wars intensify, Netflix faces stiff competition from HBO, ViacomCBS, and Amazon as its market share slips. As a result, the impact score for “HBO Max,” “Paramount,” and Prime Video are projected to grow significantly into 2022, while Netflix lags in consumer conversation.

The most significant risk and opportunity for Netflix moving forward will be its ability to grow internationally. Netflix has struggled to gain new subscribers, with a slowdown in growth in the APAC region, which had previously been the largest source of growth over the past two quarters. Recently, Netflix announced that it would be reducing its subscription prices in India and developing 20 original Korean dramas. Our impact score for “Netflix” and “International Growth” is projected to grow in the latter half of 2022.

Is this to say Netflix is done? Of course not. Netflix will continue to be the dominant player in the streaming industry but will need to remain competitive in the short term while pivoting into new markets in the future. Netflix is best positioned to grow internationally compared to its streaming service competitors, which may be due to its loyal customer base. According to ANTENNA, the churn rate for Netflix customers is 2.4% through the beginning of 2021, while its competitors average a customer churn rate of 6.5%. This partially explains why the stock went up following the recent price increase announcement because investors know that Netflix subscribers are the most loyal out of all the streaming competitors.

In the short term, Netflix will continue to struggle as the realities of its competitive situation play out and the macro realities of the tech sector slow down. However, in the long-term, if Netflix can capitalize on international growth opportunities and continue to produce high-quality content, then Netflix stands a chance at maintaining its dominance in the streaming industry.

About NWO.ai

NWO.ai's predictive platform enables leading Fortune 500 companies and government agencies to anticipate and track global cultural shifts by aggregating, analyzing, and producing actionable reports on human-generated data. We are leveraging petabytes of external, noisy, and unstructured data from various sources –including search, social media, blogs, news, patent databases, SEC filings and we are continuously adding more sources. Our mission is to answer the what, when, and most importantly, 'why' behind a consumer trend and enable our customers to detect these shifts as early as possible.

P.S. We're hiring! Check out our open positions and let us know if you'd be a good fit for our team. We're growing quickly and adding several engineering roles to help us decode the anatomy of next.

Thank you for reading. If you liked the piece, please help us spread the word and invite your friends to sign up here.

Disclosure: NWO.ai does not have a position in any equities, commodities, or cryptocurrencies mentioned. Nothing contained in this website should be construed as financial advice

Join the conversation.