Happy Post-President's Day, readers! Last week NWO.ai's earnings pick of the week was Fiverr ($FVRR). As anticipated, Fiverr delivered on its earning results, reaching an intraday trading high of $89.91 from its previous day's close of $75.84 (up 18.59%) and closing the day up 3.5%. Fiverr's revenue grew 43% year over year, active buyers increased 23% year over year, and future guidance indicates 25-27% year over year growth in FY 2022. NWO.ai remains bullish on the long-term outlook for Fiverr as consumers and workers embrace the freelance economy.

As we head into this week, geopolitical tensions continue to strain between Russia and the West. Russia announced that it will recognize the breakaway regions of Ukraine and send in "peacekeepers" to the region. Markets will be in a reactionary mode as the situation on the Ukrainian border evolves by the minute. Despite the geopolitical risks and the shortened trading week, we have identified a stock with another severe narrative violation and great long-term opportunity. The stock? Teladoc ($TDOC). Let's dive into it.

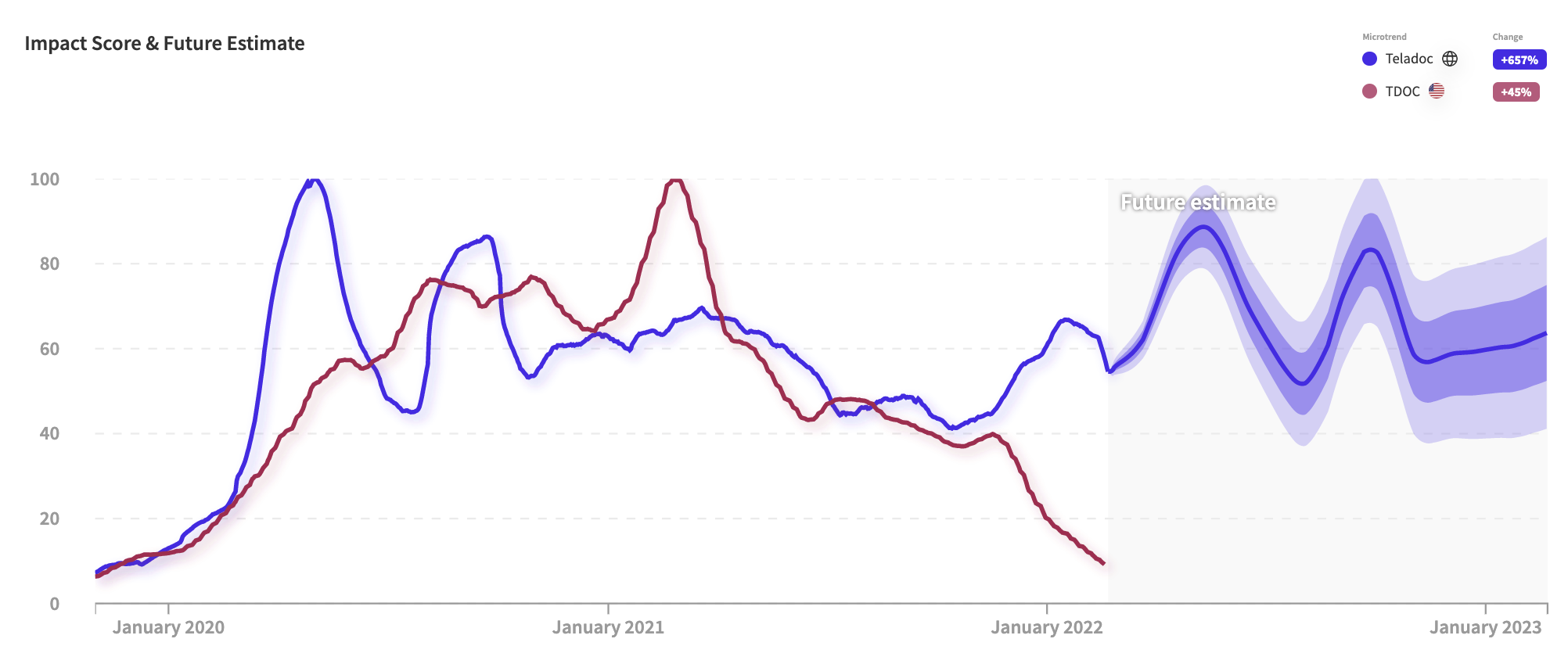

Teladoc Health, Inc is a US-based telemedicine and virtual healthcare company that connects patients with medical providers. They connect patients with various medical professionals, including primary care physicians, specialists, mental health therapists, etc. Over the last year, Teladoc is down 78%, from its ATH of $294.94 to its current price of around $65. Its current market cap of $12 billion is back near its market cap before the Pandemic in March 2020. Factors that have led to the drop include: the broader tech market slowdown, market competition, and unfounded fears that telemedicine is a COVID-19 fad. However, despite the decline, the consumer interest in Teladoc has continued to grow, making Teladoc Health Inc. ready for a comeback.

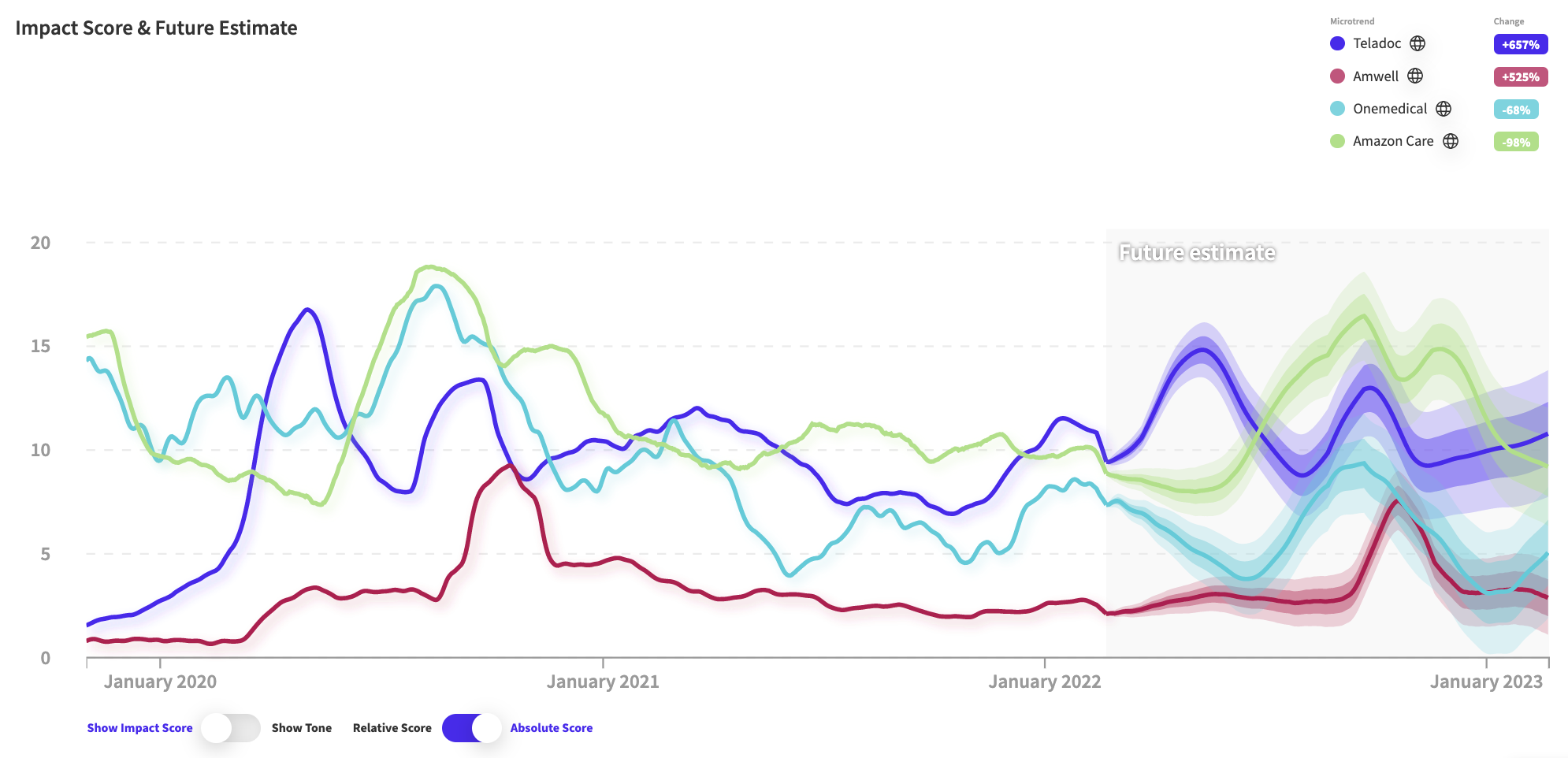

Teladoc faces a lot of competition in the telemedicine space. The most significant challenges will come from Amwell, Onemedical, and Amazon, with its Amazon Care platform. NWO.ai quantified the amount of consumer chatter for each competitor and found that Teladoc leads the companies in the space, with Amazon Cares closely following.

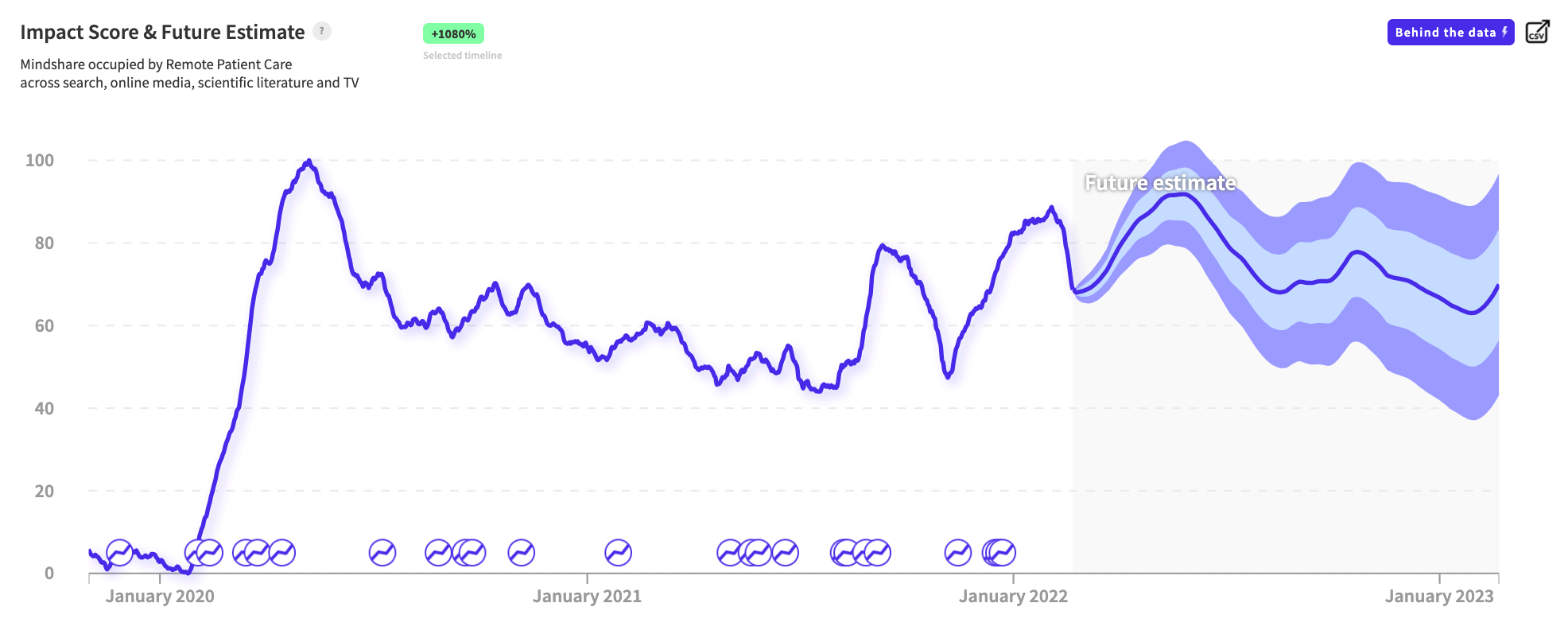

While COVID-19 has driven the recent industry growth, it has only accelerated the consumer trend towards telehealth, not created it. According to industry estimates, in 2020, the telehealth market size was $144.38 billion. The industry is forecasted to grow 32.1% on average year over year between 2021 and 2028. According to a McKinsey survey, only 11% of consumers used telehealth services before the pandemic, and 40% of consumers indicated that they plan to continue to use telehealth services after the pandemic. NWO.ai's impact score for "Remote Patient Care" has sustained its momentum since 2020 and is projected to continue to grow in the near term. Telehealth is a trend that will remain as consumers appreciate the convenience of scheduling and talking to their healthcare providers instantly.

Based on consumer conversations, NWO.ai's signal forecast, and a favorable consumer shift to embracing telemedicine, we anticipate Teladoc beating revenue expectations and providing strong future guidance. In addition, Teladoc's management has previously indicated that they expect 25 to 30% year-over-year revenue growth through 2024 and will continue to build upon its successes. We are bullish on the stock based on these factors, and our twelve-month price target is $125.

Thank you for reading. If you liked the piece, please help us spread the word and invite your friends to sign up here.

Disclosure: NWO.ai does not have a position in any equities, commodities, or cryptocurrencies mentioned. Nothing contained in this website should be construed as financial advice.

Join the conversation.