By popular demand, we are back this week with our earnings pick of the week. Last week our earnings pick was $CMG which opened up 7.87%. Our estimated 6-month price target of $1700 for $CMG is still on track based on consumer popularity with the food chain.

This week NWO.ai has identified a severe narrative violation that brings into question this company's current stock price. A narrative violation is a condition in financial markets where the underlying price of an asset contradicts the direction of the global narrative surrounding the asset. Thanks to NWO.ai's powerful signal analysis tools and petabytes of external data, we can measure the shift in the momentum of conversations around a company and its activities in a quantified manner, enabling our clients to identify narrative violations ahead of time. Last week, we detected a violation with Affirm, which eventually caused a 55% drop. The stock in question this week is Fiverr, an Israeli online marketplace for freelance services, which is set to announce its earnings tomorrow morning. Let's dive into it.

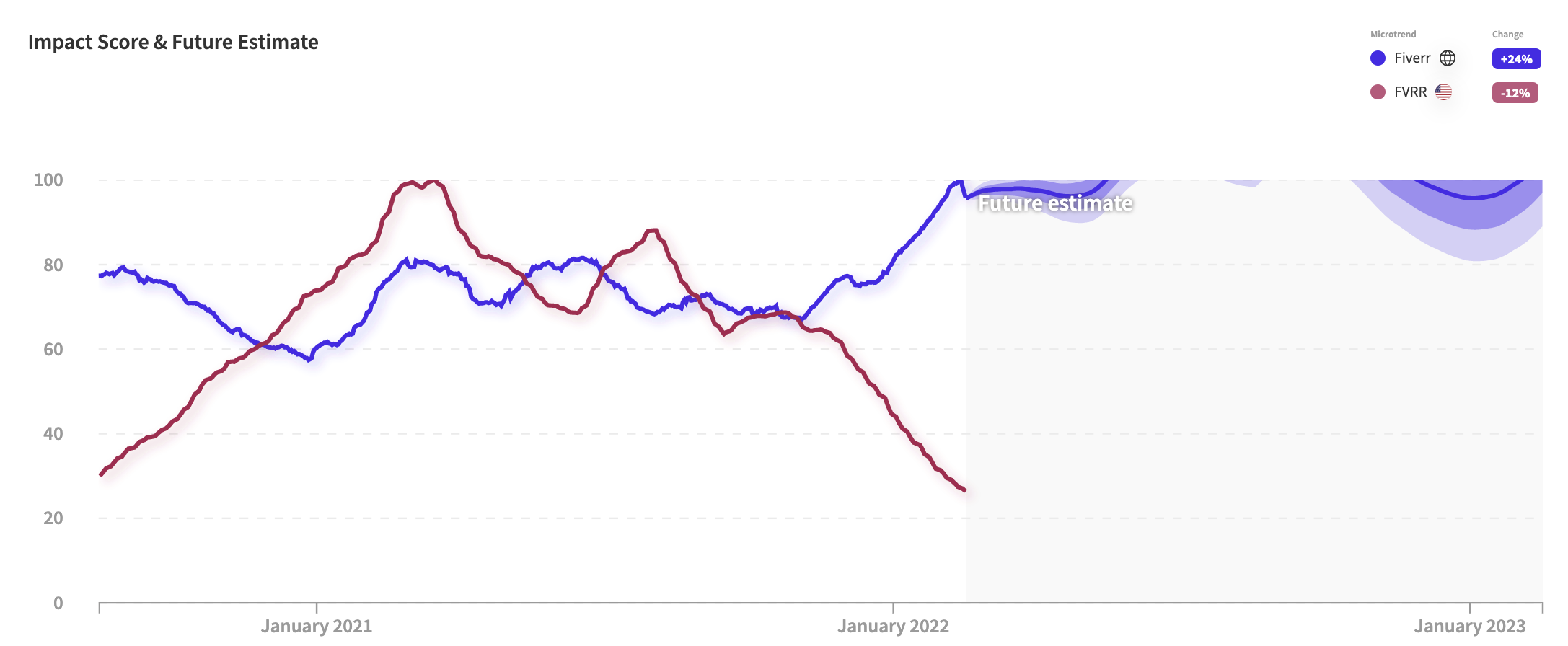

Over the past year, Fiverr's stock price has declined over 75%, down from its ATH of $325, despite the company growing its active buyer base by 33% year over year, spend per buyer climbing by 20%, and year over year revenue growth of around 55% in Q3 2021. We anticipate that the stock is due for a turnaround. The impact score for Fiverr is projected to explode in 2022, and macroeconomic trends favor the company's future guidance.

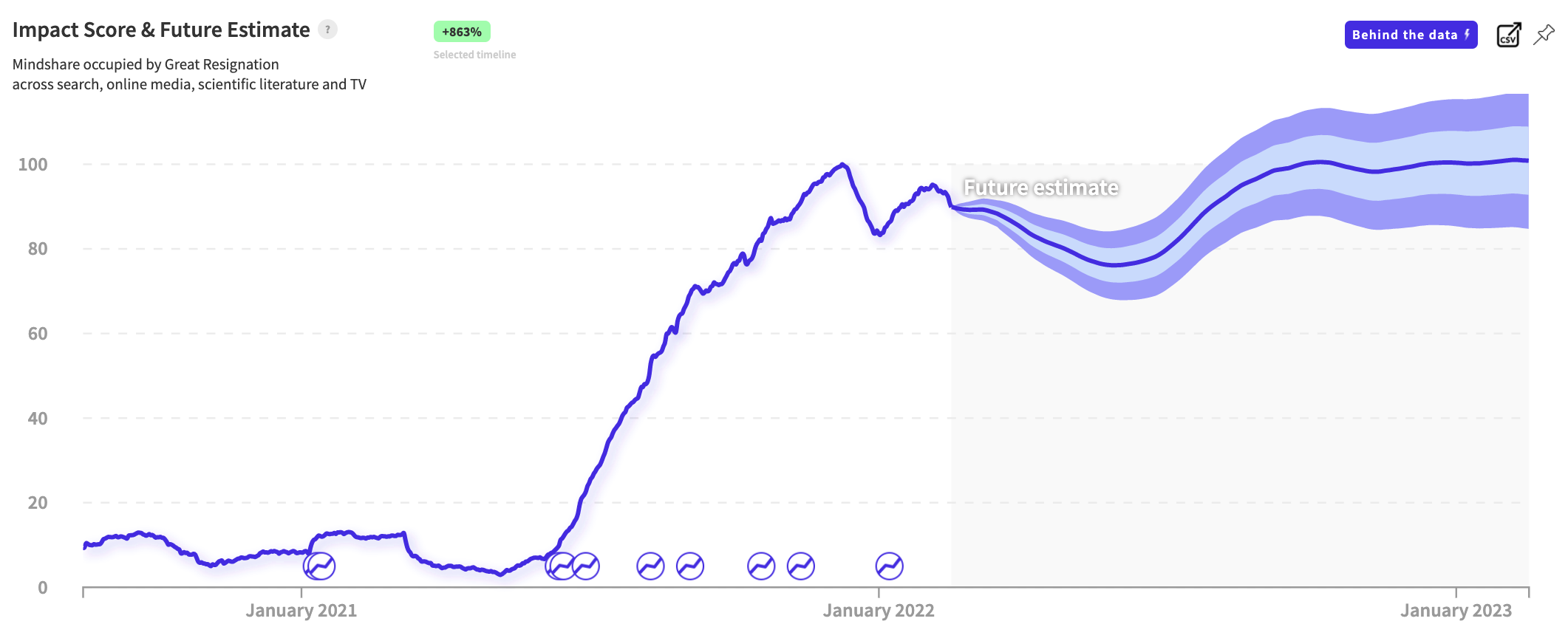

In 2021, an average of 3.95 million American workers quit their jobs each month (in 2019, the average rate was 3.5 million). Moreover, the "Great Resignation" signal is projected to continue to grow into 2022. So far, in 2022, the trend has not slowed down as workers look to find higher-paying and more flexible opportunities. One of these new opportunities? Freelance and Gig work.

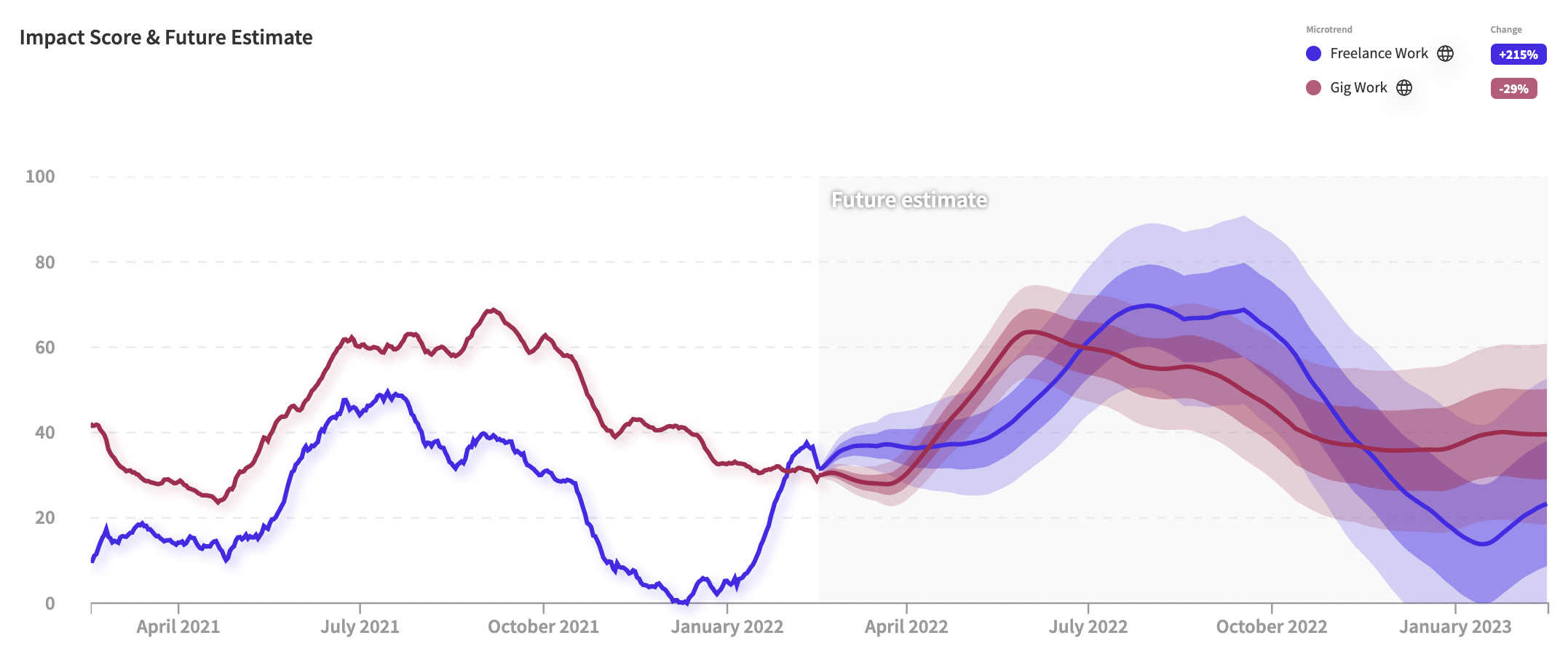

Freelance and Gig work will continue to grow after the pandemic, as some workers find that they can make more money, have more flexible schedules, and be happier with their work (82% of freelancers are more satisfied than traditional workers). A survey conducted by Statista found that 50% of Gen Z workers aged 18-22 are currently engaged in freelance work. From 2017 to 2020, freelance workers grew by 10 million. Additionally, as companies struggle to find new employees, they may turn to freelancers to fill gaps. As a result, companies such as Fiverr stand to benefit from the shift in the labor market.

Based on the consumer conversations and NWO.ai's signal forecast, we anticipate Fiverr will beat revenue expectations, and future guidance will be strong as the company capitalizes on these new labor trends. Based on these factors, we are bullish and our six-month price target for $FVRR is $100.

Thank you for reading. If you liked the piece, please help us spread the word and invite your friends to sign up here.

Disclosure: NWO.ai does not have a position in any equities, commodities, or cryptocurrencies mentioned. Nothing contained in this website should be construed as financial advice.

Join the conversation.