Edited by Julia Myers and Christian Thompson

One of the greatest beneficiaries of the pandemic was the firearms industry, which saw record sales in 2020. A mix of pandemic-related anxiety, anger against the government's mitigation efforts combined with nationwide protests and riots triggered unprecedented growth in first-time gun owners. As NWO.ai had accurately predicted, the narrative around contested elections in 2020 brought a "perfect storm" of frustrations and anxieties to the fore.

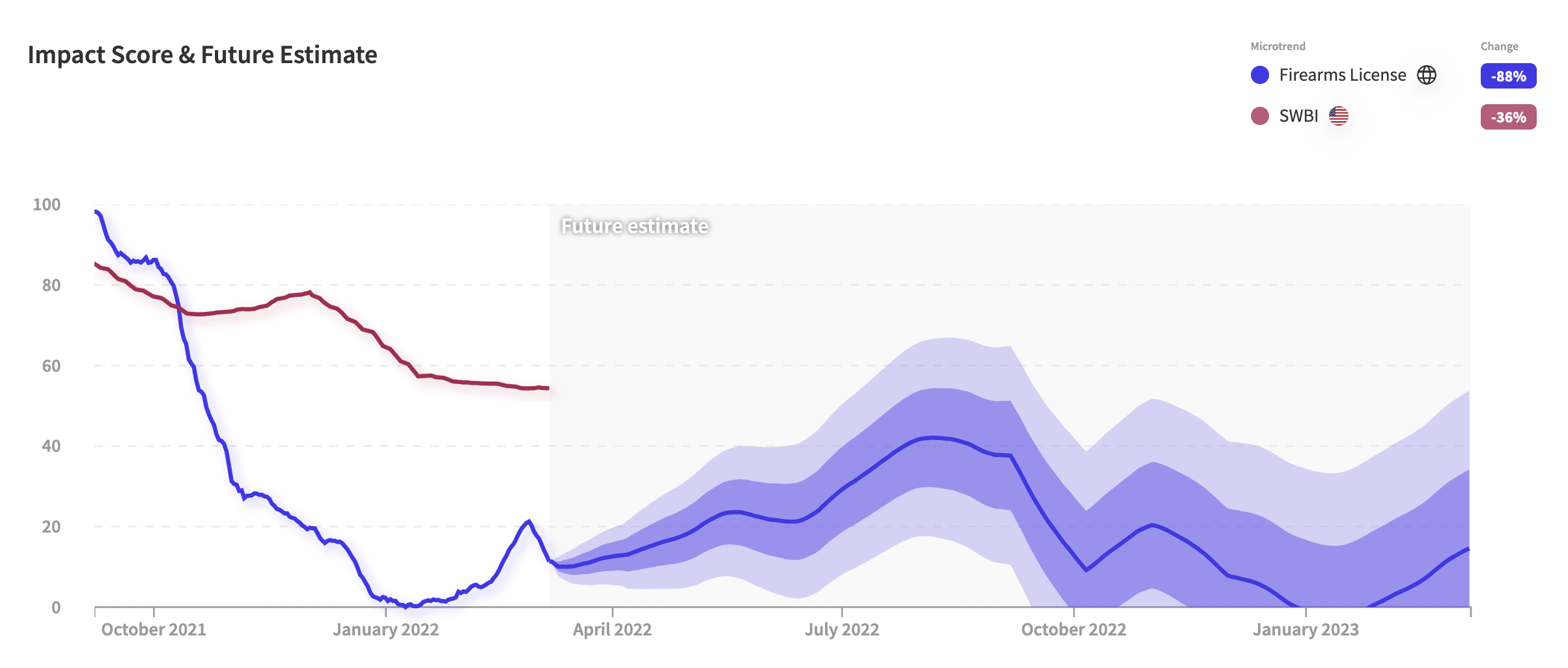

But that shift has been dramatically upended again, with the fear narrative seemingly running its course. A quick search on NWO.ai for "firearms license" reveals our proprietary impact score (which measures the performance of the trend over time across social media, news, search, financial literature, and television). The Signal's performance is a close proxy for new firearm demand. The Signal showed a massive spike in August 2021, followed by a consistent decline. $SWBI's third fiscal quarter, which ended on January 31, 2022, captures a big chunk of said decline, followed by a flat demand through the end of the period.

My hunch at the time was that the firearms license Signal is highly correlated to the price of Smith & Wesson's stock. I used NWO.ai's powerful financial overlay tool to visualize NWO.ai's Signal for Firearms License vs. $SWBI (stock) to confirm my hypothesis more quantitatively. The correlations were startling, exceeding 75%, with the NWO counterpart leading the stock by almost 14 days.

While the decline would be embodied in the earnings, another point to consider is the future guidance - it would be bearish to neutral at best, based on NWO.ai's forward-looking forecast.

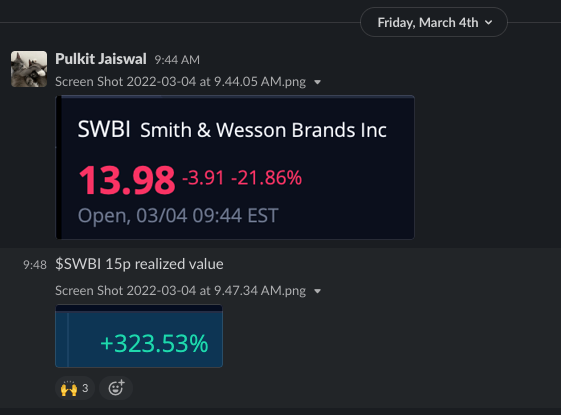

Based on all the factors above, we recommended purchasing $15 strike puts before market close on Thursday, March 3, with the closing price hovering around $18 (factoring in a 16% decline after earnings release). Shortly after, Smith & Wesson Brands released its results, generating $177.7 million in net sales during its third quarter of fiscal 2022, a 31% year-over-year decrease. Its chief executive admitted during the earnings call that the market for guns "has cooled significantly from the height of the pandemic surge,"

Sure enough, $SWBI opened below $14 the following day, and the $15 strike puts returned almost 342% at the time of exiting (shortly after market open).

Thank you for reading. If you liked the piece, please help us spread the word and invite your friends to sign up here.

Disclosure: NWO.ai does not have a position in any equities, commodities, or cryptocurrencies mentioned. Nothing contained in this website should be construed as financial advice

Join the conversation.